By Max Colice

Over the past 10 years, the Belmont Country Club has received tax breaks totaling more than $4 million on its property tax bills thanks to a state law called Chapter 61B. Chapter 61B allows country clubs and other private nonprofit organizations to get a 75% discount on property taxes for recreational land, including golf courses. Belmont taxpayers pay for this enormous tax benefit. That’s because when one taxpayer’s bill goes down, everyone else’s bill goes up to offset that reduction. In other words, every taxpayer in Belmont has been subsidizing the Belmont Country Club’s property taxes for years under Chapter 61B.

The Massachusetts Golf Association pushed Chapter 61B through the state legislature in the late 1970s in response to a Massachusetts Supreme Judicial Curt decision that increased country clubs’ assessed values—and property taxes. This decision held that properties should be assessed at their “full and fair cash value”—the fair market value or the price the land would fetch in a voluntary sale. For many country clubs, this was a rude shock. Instead of being taxed like pasture land or recreational land, their golf courses started being taxed as undeveloped land ripe for development.

For the Massachusetts Golf Association (MGA), the solution was clear: instead of increasing dues or greens fees, they lobbied for a tax break for golf courses. Relying on powerful friends in the state legislature, the MGA pushed for a state constitutional amendment creating a special tax classification for golf courses and other recreational land. The MGA promoted this state constitutional amendment as a way of preserving an environmentally friendly open and recreational space, which they called a “Green Belt,” through the Boston suburbs. They also warned that without this tax break, higher taxes would force golf courses to close or move, only to be replaced by development. Green Belt proponents also published pamphlets promising, somewhat disingenuously, that this tax break would not increase taxes on other properties:

“Will approval of Question 7 [the MGA’s proposed state constitutional amendment to lower property taxes for golf courses and other recreational land] increase taxes on homes, businesses, and industries?”

“No. Approval of Question 7 will merely authorize the Legislature to require lower assessment for open space land—not for buildings or improvements.”

In 1979, the MGA’s push for a state constitutional right to pay lower taxes morphed into Chapter 61B. Although this tax break is mandated by state law, the tax break is on property taxes collected by towns and cities. It’s available to any nonprofit organization with more than five acres of recreational or open space. If a country club applies for it, then the town has to grant it. (Not every eligible country club in Massachusetts applies for tax relief under Chapter 61B.)

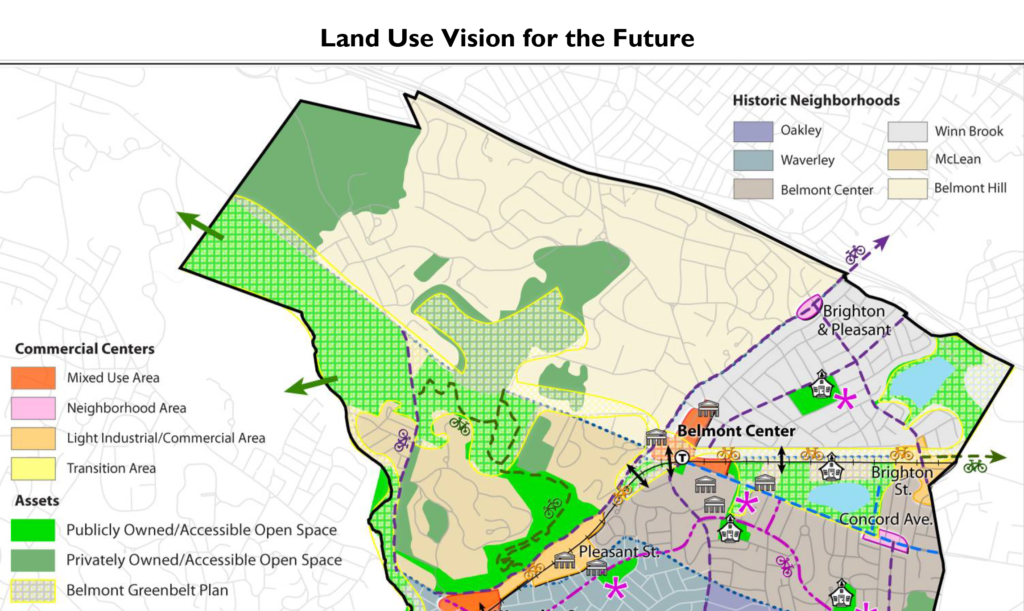

Image from Belmont’s 2010 Comprehensive Plan. Belmont Country Club appears in the northwest corner.

Chapter 61B also gives towns that grant these tax breaks a right of first refusal to purchase the land that benefits from the tax break and the right to collect 10 years of “roll-back” taxes if the land is sold and used by the buyer for a different purpose. For most towns, however, exercising the first refusal right is impractical, and the land rarely comes up for sale.

Chapter 61B succeeded dramatically in lowering property taxes for country clubs. In May 2023, the Boston Globe reported that at least 100 golf courses received property tax cuts under Chapter 61B, with 10 courses receiving breaks of about $100,000 or more, including the Belmont Country Club, which received a tax break of $367,910. And in Newton, three country clubs received tax breaks totaling about $1.75 million despite a failed override, according to the Boston Globe.

Because Chapter 61B is a state law, the state legislature must change it. This November, Belmont Town Meeting can push for that change by passing a warrant article asking Belmont’s state legislators, Senator Will Brownsberger and Representative Dave Rogers, to file a home rule petition exempting Belmont from Chapter 61B.

Better yet, Belmont’s state legislators could pursue a more comprehensive change to benefit the entire state, perhaps by working with state legislators from Newton and other disproportionately affected districts. If you are tired of subsidizing country clubs, call your Town Meeting members and your state legislators to advocate for eliminating the tax break provided to private country clubs by Chapter 61B.

Max Colice is a member of the Vision 21 Implementation Committee and a Belmont resident.

Sorry, the comment form is closed at this time.